Difference between debt settlement and consolidation: which to choose?

Anúncios

Understanding Your Options

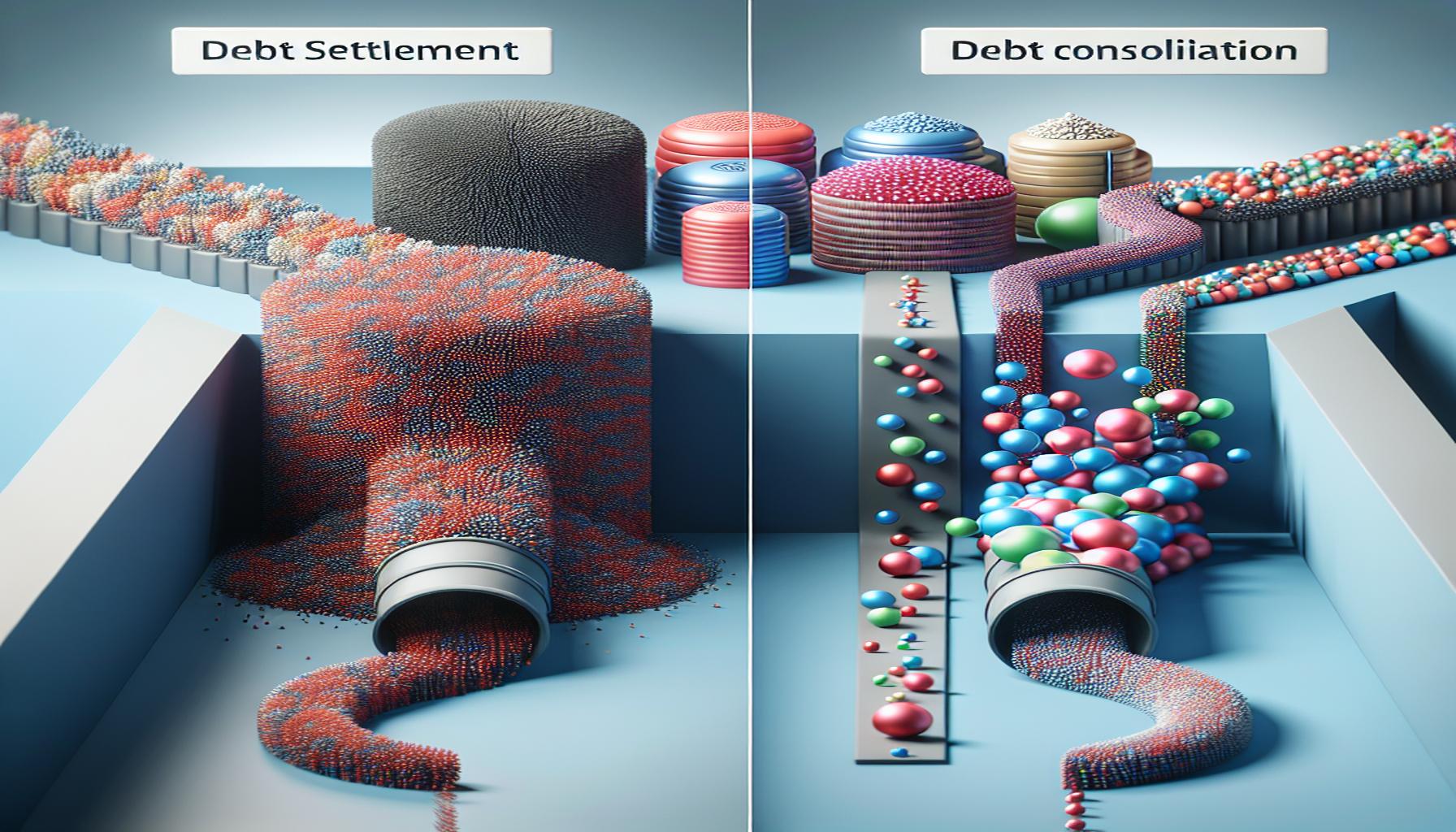

When faced with financial challenges, it is crucial to explore various strategies that can provide relief and help you regain control over your finances. Among the numerous options available, debt settlement and debt consolidation are two popular methods, each designed to alleviate financial pressure, but they operate in fundamentally different ways.

Anúncios

Debt Settlement

Debt settlement involves negotiating with your creditors to pay off a portion of your total debt, often for less than the amount originally owed. This process can result in substantial savings, but it is important to be aware of its potential impact on your credit score. Here are some key aspects of debt settlement:

- Negotiation with Creditors: You may be able to convince creditors to accept a reduced payment to clear an outstanding debt. For example, if you owe $10,000, they might agree to settle for $6,000.

- Lump-Sum Payments: In many cases, creditors prefer a lump-sum payment as it provides immediate cash. You may receive offers to settle for a lesser amount if you can pay it all at once.

- Tax Implications: Be mindful that forgiven debt may be considered taxable income by the IRS. If $4,000 of your debt was forgiven, you might need to report that amount on your tax return.

While debt settlement can offer quick relief and significant savings, it can also have long-term effects on your credit score, making it more challenging to secure loans in the future.

Anúncios

Debt Consolidation

In contrast, debt consolidation is a strategy that merges multiple debts into a single loan, designed to simplify payments and potentially lower your interest rates. Here are some essential features of debt consolidation:

- Simplified Payments: With debt consolidation, you only need to make one monthly payment instead of managing multiple payments and due dates, which can make budgeting easier.

- Lower Interest Rates: If you qualify for a consolidation loan with a lower interest rate than what you are currently paying, you might save money in the long run on interest payments.

- Improved Credit Score: As long as you make timely payments on your consolidation loan, your credit score could improve over time, enhancing your creditworthiness for future borrowing.

Making the Choice

Choosing between debt settlement and debt consolidation is not a one-size-fits-all decision. It requires a thorough understanding of your financial situation and future goals. Consider factors such as the total amount of your debt, your income, and your ability to make payments consistently.

If you are looking for quick relief and significant reductions in what you owe, debt settlement may be appealing. However, if you prefer to consolidate your debts into a manageable payment with the potential for improving your credit over time, debt consolidation may be the better route. Ultimately, the right choice will depend on your unique financial circumstances and what you hope to achieve.

CHECK OUT: Click here to explore more

Key Differences Between Debt Settlement and Consolidation

Understanding the distinct characteristics of debt settlement and debt consolidation can help you make an informed decision about which option is best for your financial situation. Let’s delve deeper into how each method works and the benefits and challenges associated with them.

Debt Settlement: Pros and Cons

Debt settlement can appear attractive due to the possibility of paying less than what you owe. However, it carries its own set of advantages and disadvantages that you should consider:

- Pros:

- Potential for Significant Savings: One of the biggest advantages is the opportunity to negotiate a lower total payoff. For instance, if you can settle a $20,000 debt for $12,000, you are saving $8,000 in the process.

- Quick Resolution: Debt settlement can often lead to faster resolution of your debts compared to other methods, potentially allowing you to eliminate financial strain sooner.

- Cons:

- Negative Impact on Credit Score: Engaging in debt settlement typically damages your credit score, as accounts may be marked as settled or unpaid.

- High Fees: Many debt settlement companies charge fees that can eat into your savings. Always read the fine print and be aware of these costs before proceeding.

Debt Consolidation: Advantages and Disadvantages

Debt consolidation aims to make your financial life simpler by reducing your number of payments and potentially lowering your interest rates. It comes with its own pros and cons as well:

- Pros:

- Streamlined Payments: Consolidating allows you to combine multiple debts into one loan, making it easier to manage your finances with just one monthly payment.

- Improved Cash Flow: A lower interest rate means you may pay less each month, which can provide some financial breathing room.

- Cons:

- Potential for Longer Repayment Terms: While your monthly payment may be lower, you might end up extending your repayment period, which can lead to paying more in interest over time.

- Risk of Accumulating More Debt: If you do not change your spending habits, consolidating debts may only provide temporary relief while allowing you to take on more debt.

By evaluating these pros and cons, you can better understand how both debt settlement and debt consolidation affect your financial well-being. It’s essential to carefully weigh these factors in relation to your personal situation before making a choice. Always remember, the best solution is the one that aligns with your long-term financial goals while providing the necessary relief you need in the present.

SEE ALSO: Click here to read another article

Evaluating Your Options: Which Choice Fits Your Needs?

As you explore the options of debt settlement and debt consolidation, it is essential to think about your financial habits, current debt situation, and long-term goals. Both approaches offer unique solutions for managing debt, but they cater to different needs. To determine which is best for you, consider the following factors:

Your Current Financial Situation

Your current financial situation is a crucial factor in deciding between debt settlement and consolidation. If you are facing overwhelming debt with limited income, debt settlement might provide a more immediate solution. For instance, if you have accrued multiple unpaid credit card debts and are on the brink of default, negotiating a lower payoff could relieve a significant burden quickly. However, this option requires you to be prepared for potential penalties, such as damaged credit scores and collection actions from creditors.

Conversely, if you have a steady income but are struggling to keep up with multiple monthly payments, debt consolidation may be more suitable. By combining your debts into a single loan with a lower interest rate, you can simplify your payments and streamline your monthly budget. This approach is particularly effective if you have a stable financial situation that allows you to manage consistent payments over time.

Your Long-Term Financial Goals

Consider what you want to achieve financially in the long term. If your goal is to rebuild your credit score, debt consolidation may be a better path. By paying off your debts in full and maintaining regular payments, you can positively influence your credit history once the dust settles. It’s important to remember that improving your credit score can unlock better loan and mortgage options in the future.

On the other hand, if your immediate concern is to alleviate debt stress within a short time frame, debt settlement could provide that quick relief, despite the potential long-term credit repercussions. However, you must weigh how the status of settled debts may affect any future financial opportunities, such as securing a mortgage or auto loan. For example, many lenders view a history of settled accounts as a warning sign and might hesitate to lend to you until you reestablish your creditworthiness.

Impact on Your Financial Stability

It is also vital to consider how each option could impact your overall financial stability. Debt settlement often requires a lump sum payment and may involve negotiating with creditors for weeks or months. This process can be stressful and uncertain, particularly if you are not working with reputable negotiators. It’s essential to approach professionals with a track record in debt settlement to avoid scams and ensure fair practices.

In contrast, debt consolidation provides predictability in payments, which can be comforting for those who want to regain control over their finances. Knowing exactly how much you owe each month can help you budget more effectively and reduce the likelihood of falling back into debt. This predictability may also give you the financial freedom to save for emergencies or make investments, helping to stabilize your overall financial health.

Ultimately, the choice between debt settlement and consolidation hinges on your unique circumstances, preferences, and future financial goals. Taking the time to analyze these factors will empower you to make a well-informed decision that aligns with your lifestyle and aspirations.

CHECK OUT: Click here to explore more

Final Thoughts: Choosing the Right Path for Your Debt

In conclusion, understanding the difference between debt settlement and debt consolidation is crucial for making an effective financial decision. Each strategy offers distinct advantages tailored to specific financial situations. If you are currently overwhelmed by debt and need immediate relief, debt settlement may provide a viable escape route by allowing you to negotiate for a reduced payment. However, keep in mind the potential impact on your credit score and the long-term implications that might affect future borrowing opportunities.

On the other hand, if you are in a stable financial position and simply want to streamline your multiple payments, debt consolidation can be a more suitable option. By transforming your debts into a single monthly payment with a lower interest rate, you can manage your finances with greater ease, thereby enhancing your ability to rebuild your credit score over time.

Ultimately, the decision between debt settlement and consolidation should align with your current financial health, your long-term goals, and your level of comfort with risk and uncertainty. Take the time to evaluate your personal circumstances, and consider speaking with a financial professional to explore what option best suits your needs. Remember, the goal is not just to eliminate debt, but to do so in a way that leads to a healthier financial future.

Related posts:

How to use a personal loan to pay off high-cost debts

How to Use Refinancing Programs to Pay Off Debts Quickly

When is it Worth Declaring Bankruptcy as a Financial Recovery Strategy

How to Consolidate Debts with Low Interest Rates Safely

How to Create a Debt Repayment Plan That Actually Works

The impact of debt on credit score and how to recover

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.