How to assess risk before investing in startups and local businesses

Investing in startups and local businesses presents opportunities and challenges. Thorough risk assessment involves analyzing both internal factors, like financial health and management quality, and external factors, such as market trends and competition. A holistic approach enhances decision-making and boosts the likelihood of successful investments.

Difference between passive and active investments and how to apply them

This article explores the key differences between passive and active investment strategies. It outlines the advantages and considerations of each approach, helping investors determine the best fit for their goals, risk tolerance, and commitment level. A balanced approach combining both strategies is also discussed for optimal portfolio management.

How to Build a Balanced Investment Portfolio from Scratch

Creating a balanced investment portfolio involves understanding asset allocation, diversification, and personal risk tolerance. Start by defining clear financial goals and assess your financial situation. Regularly rebalance and research investments to enhance stability and growth. This proactive approach sets the foundation for long-term financial success.

How to Use Refinancing Programs to Pay Off Debts Quickly

This article explores how refinancing programs can effectively reduce debt. It highlights the benefits of lower interest rates, debt consolidation, and flexible repayment terms. Additionally, it guides readers through evaluating their financial situation, choosing suitable refinancing options, and emphasizes the importance of informed decision-making and budgeting for financial success.

How to Identify Credit Traps That Increase Your Debt

The article highlights common credit traps that can lead to overwhelming debt, such as high-interest loans and misleading promotional offers. It emphasizes the importance of financial literacy, proactive management of credit habits, and establishing an emergency fund to maintain control over finances and promote long-term stability.

When is it Worth Declaring Bankruptcy as a Financial Recovery Strategy

Declaring bankruptcy can be a vital step for those overwhelmed by debt, providing a fresh start and relief from financial strain. Various circumstances, like job loss or medical expenses, may necessitate this decision. Seeking professional guidance is essential to navigate the complexities and align choices with long-term financial goals.

The impact of debt on credit score and how to recover

This article explores how debt influences credit scores and offers strategies for recovery. It emphasizes the importance of credit utilization, payment history, and managing different types of debt. Practical steps like budgeting, timely payments, and carefully applying for new credit can help improve one’s financial health over time.

Debts with the government: how to negotiate overdue taxes and fines

Navigating government debts, such as overdue taxes and fines, can be overwhelming. This article offers practical strategies for effective negotiation, including understanding your financial situation, exploring payment plans, and utilizing Offers in Compromise. Clear communication and diligent documentation are essential for achieving a manageable resolution and ensuring financial stability.

The role of financial coaching in managing personal debts

Financial coaching provides essential support for individuals struggling with personal debts. By offering personalized guidance on budgeting, debt repayment strategies, and financial literacy, coaches empower clients to regain control over their finances, build savings, and foster a positive mindset, leading to long-term financial stability and growth.

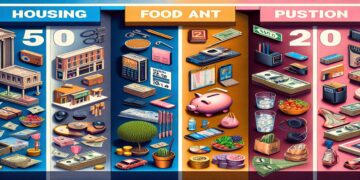

How to use the 50/30/20 rule to organize debt payment

The 50/30/20 rule is a budgeting strategy that allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. This framework simplifies debt management and encourages financial stability through careful planning and regular adjustments based on changing circumstances.