How to Apply for the Capital One Venture X Credit Card Step-by-Step

Anúncios

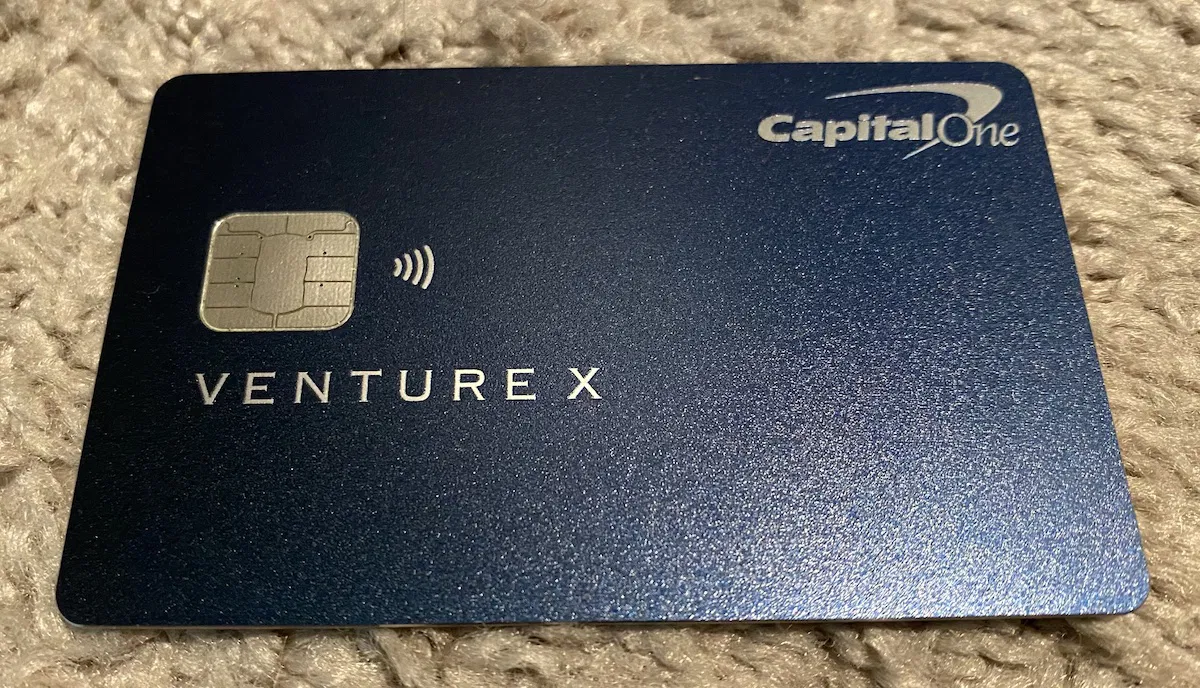

Unlock a world of opportunities with the Capital One Venture X Credit Card, a premium choice for those who love to travel and enjoy exclusive perks. This card is designed to elevate your financial experience, offering not only the freedom of effortless transactions but also a range of rewarding benefits. Imagine earning unlimited miles on every purchase and accessing exclusive airport lounges as you embark on your adventures.

One of the standout features of the Capital One Venture X is its generous rewards program, helping you to maximize your spending and travel further on every dollar. Plus, you’ll gain peace of mind with extensive travel protections and no foreign transaction fees, making it a trusted companion for your journeys abroad. If you’re ready to take your financial life to the next level, understanding how to apply for this card is crucial. Let’s embark on this step-by-step journey to smarter financial decisions.

Anúncios

Explore the Benefits of Capital One Venture X

1. Generous Rewards Program

The Capital One Venture X card offers a remarkable rewards program that inspires a love for travel and discovery. Earn 2X miles on every purchase, every day, and an incredible 10X miles on hotels and rental cars booked through Capital One Travel. This card allows you to accumulate rewards effortlessly, turning your everyday expenses into extraordinary experiences. To maximize these benefits, consider shifting your everyday purchases onto this card, allowing you to accumulate more travel miles faster.

2. Travel Perks and Benefits

With Capital One Venture X, access to exclusive travel perks becomes a reality. Enjoy perks such as complimentary airport lounge access to the Capital One Lounges and Priority Pass Select, making your travel experience smoother and more luxurious. Additionally, the card offers up to a $300 annual travel credit that automatically applies to travel bookings made through Capital One Travel. Apply this credit when booking flights or accommodations to reduce your travel expenses and elevate your journey.

Anúncios

3. No Foreign Transaction Fees

For the savvy traveler, avoiding costly fees is a necessity. The Capital One Venture X card ensures your travels remain cost-effective by waiving foreign transaction fees. This benefit allows you to manage your finances abroad without the worry of unexpected charges. Use this feature to explore global destinations and indulge in local cuisines, all while maintaining financial calm and confidence.

4. Exceptional Insurance Coverage

The Capital One Venture X card is built with a commitment to secure and safe travels, offering comprehensive travel insurance coverage. From trip cancellation insurance to lost luggage reimbursement, you’re equipped to travel with peace of mind. Keep assurance high and stress low by understanding the claims process before your journey so you’re prepared in case the unexpected occurs.

LEARN MORE DETAILS ABOUT CAPITAL ONE VENTURE X

| Benefits | Features |

|---|---|

| Generous Travel Rewards | Earn 2X miles on all travel and dining purchases, accelerating your journey to unforgettable adventures. |

| No Foreign Transaction Fees | Enjoy seamless travel globally without the extra charges that can often add up. |

The Capital One Venture X card stands as a beacon for those seeking to enhance their travel experiences. With its ability to rack up rewards effortlessly, each purchase transforms into an opportunity for exploration and adventure. Aspiring travelers can seize the chance to transform day-to-day spending into valuable travel rewards, creating memories that last a lifetime.Additionally, the absence of foreign transaction fees offers peace of mind for international wanderers, removing barriers and encouraging spontaneous exploration without the worry of added costs. The Venture X card is more than just a financial tool; it’s a passport to a world of experiences, urging you to travel responsibly and embrace new horizons with open arms.

Requirements for Applying for Capital One Venture X

- Minimum Credit Score: To qualify for the Capital One Venture X credit card, it is recommended to have a good to excellent credit score, typically 700 and above. This ensures your ability to manage credit responsibly.

- Proof of Income: Applicants need to demonstrate stable and sufficient income to handle the card’s potential credit limits. Be prepared to provide recent pay stubs, W-2 forms, or other documentation that verifies your earnings.

- Valid Social Security Number: A valid Social Security Number is required to apply for the card, as it helps in verifying your identity and evaluating your credit history.

- U.S. Citizenship or Permanent Residency: You must be a U.S. citizen or a permanent resident to apply, ensuring you meet the bank’s eligibility criteria for this credit product.

- Age Requirement: Applicants must be at least 18 years old. It’s important to be mindful of the responsibility that comes with managing a credit card at any age.

LEARN MORE DETAILS ABOUT CAPITAL ONE VENTURE X

Applying for the Capital One Venture X Credit Card

Step 1: Visit the Official Capital One Website

Begin your journey towards a smarter financial future by visiting the official Capital One website. Once you’re there, navigate to the credit cards section where you’ll find an array of options. Look for the prestigious Capital One Venture X credit card. This card is designed to inspire, offering remarkable benefits that align with your travel and lifestyle aspirations.

Step 2: Review the Benefits and Requirements

Before applying, take a moment to bask in the extensive benefits that the Capital One Venture X card offers. Explore its travel rewards, fee structures, and exclusive perks. Ensure you meet the eligibility criteria – this could include age, income, and credit score requirements. A conscious understanding at this stage sets the foundation for financial empowerment.

Step 3: Start Your Application

With a heart full of aspirations and responsible intent, click on the “Apply Now” button. This is your gateway to a world of opportunities. You’ll be prompted to fill in personal information such as your name, address, Social Security number, and financial details. Honesty and accuracy here will pave your path to success.

Step 4: Await Approval

After submission, your application undergoes a thorough review process. Use this waiting period to reflect on your financial goals and strategies, preparing yourself for the responsibilities that come with credit. Remember, approval might be immediate, or it could take a few days. Patience and positivity are your allies.

Step 5: Activate Your Card

If approved, rejoice in the arrival of your Capital One Venture X card. Follow the instructions given to activate your card and embrace the beginning of your enriched lifestyle journey. With each swipe, remember the conscious decision you made for better financial well-being.

GET YOUR CAPITAL ONE VENTURE X THROUGH THE WEBSITE

Frequently Asked Questions About the Capital One Venture X Credit Card

What are the main benefits of the Capital One Venture X credit card?

The Capital One Venture X credit card offers a plethora of benefits that go beyond the ordinary. As a cardholder, you enjoy unlimited 2X miles on every purchase, making each transaction a step closer to your next adventure. Plus, earn 10X miles on hotels and rental cars booked through Capital One Travel, and 5X miles on flights booked in the same portal. Additionally, cardholders receive an annual travel credit and complementary access to airport lounges worldwide, elevating your travel experience.

Is there an annual fee for the Capital One Venture X credit card?

Yes, there is an annual fee of $395, but the value outweighs the cost with the benefits and credits provided each year. The travel credit alone offers a great return, along with the significant miles earning potential and exclusive perks designed to enhance your lifestyle.

How does the mile redemption work with Capital One Venture X?

Redeeming miles with the Capital One Venture X card is flexible and straightforward. Miles can be used to cover travel purchases like flights, hotels, and car rentals or transferred to over 15 travel loyalty programs, giving you the freedom to choose how you utilize your rewards. Each mile is worth approximately 1 cent when redeemed towards travel, empowering your next journey with unforgettable experiences.

What is the sign-up bonus for new Capital One Venture X cardholders?

New cardholders can unlock a generous sign-up bonus by meeting the spending requirements within the first few months. This initial bonus significantly jumpstarts your reward earnings, paving the way for memorable travel opportunities. You’ll need to check the current offer at the time of application to know the exact bonus details, as these can periodically change.

Does the Capital One Venture X offer any travel protections or insurances?

Indeed, the Capital One Venture X card includes a suite of travel protections to ensure peace of mind while you’re away from home. This includes travel accident insurance, trip delay reimbursement, and lost luggage reimbursement. In addition, you’re covered with primary rental car insurance when you rent a vehicle using your card. These protective features encourage you to embark on your journeys brimming with confidence and security.

Related posts:

How to Identify and Avoid Online Credit Card Scams

How to Apply for Discover it Cash Back Credit Card Step-by-Step Guide

Apply for the Goodyear Credit Card Step-by-Step Guide to Approval

How to use a credit card without compromising your monthly budget

Apply for the US Bank FlexPerks Gold American Express Credit Card Now

When is it advantageous to split purchases on a credit card

Linda Carter is a writer and financial expert specializing in personal finance and financial planning. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her knowledge on the our platform. Her goal is to empower readers with practical advice and strategies for financial success.